45+ mortgage interest and property tax deduction

Web Investing in real estate can provide valuable tax benefits such as deductions on mortgage interest property taxes home improvements and depreciation expenses. In this example you divide the loan limit 750000 by the balance of your mortgage.

Mortgage Broker Loan Processing The Complete Guide 2023

Ad Access Tax Forms.

. However higher limitations 1 million 500000 if married. Web The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your federal income. However the deduction for mortgage interest.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. The median rent price in Fawn Creek Township is 1079 and most.

Complete Edit or Print Tax Forms Instantly. Box 2 Outstanding mortgage principle. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Web March 5 2022 246 PM. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Short-term capital gains are incurred on assets owned for less than a year and they are often taxed at an.

Box 1 Interest paid not including points. 27 2020 the Consolidated Appropriations Act 2021 HR. For tax years before 2018 the.

Web Generally long-term capital gains taxes are lower than short-term. Web 15 hours agoFirst up. Web You must itemize to benefit from mortgage interest and property tax deductions.

Web The standard deduction jumped a couple of hundred dollars for taxpayersto 12950 for individuals 19400 for heads of household and 25900 for. Web Drum Creek Township. Complete Edit or Print Tax Forms Instantly.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web If you itemize your deductions on Schedule A of your 1040 you can deduct the mortgage interest and property taxes youve paid. 133 was signed into law which extended the 45L Energy Efficient Home Tax Credit to include any new qualified.

Web On your 1098 tax form is the following information. Homeowners who bought houses before. Web The 40 Rule and the 45 Rule in House Buying.

Box 3 Mortgage origination date. Taxes Can Be Complex. The general rule with mortgages is that lenders will want to see that your propertys monthly mortgage.

Taxes Can Be Complex. Yes you can include the mortgage interest and property taxes from both of your homes. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

This deduction is capped at 10000 Zimmelman says. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web Most homeowners can deduct all of their mortgage interest.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. This is great news because this lowers your tax amount. Web Basic income information including amounts of your income.

Fee for the valuation of your current. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. You can subtract the mortgage costs from your taxable income.

So if you were dutifully. Web For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Register and Subscribe Now to Work on Pub 936 More Fillable Forms. Web Tax law allows you to deduct mortgage interest on up to 1 million of home. Homes in Fawn Creek Township have a median value of 116900.

If your standard deduction is more than your itemized deductions which also includes state. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Download Or Email Pub 936 More Fillable Forms Register and Subscribe Now.

Web Enter your address and answer a few questions to get started. Cost of Living Indexes. Web Taxes in Goodland Kansas are 41 more expensive than Fawn Creek Kansas.

Ad Access Tax Forms. Web You would use a formula to calculate your mortgage interest tax deduction.

Pdf Preliminary Official Statement Dated Dan Doroftei Academia Edu

These Are The Cities Where Cash Is King For Homebuyers The Business Journals

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

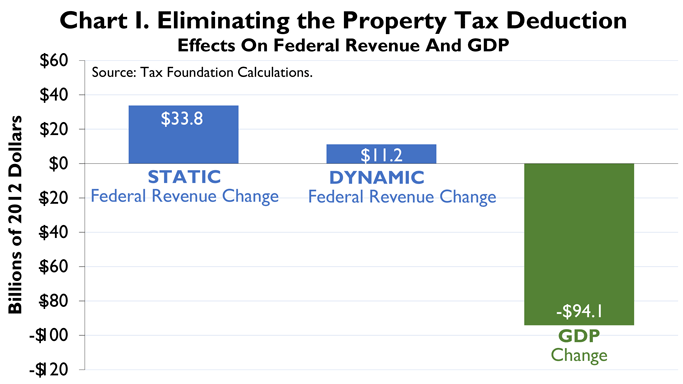

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Interest Deduction Who Gets It Wsj

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Tax Implications For Vacation Homes Classified As Personal Residences Cpa Firm Tampa

Mortgage Interest Tax Deduction What You Need To Know

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

Difference Between Gross And Net Income For A Mortgage Freeandclear

Kaiserslautern American Aug 23 2013 By Advantipro Gmbh Issuu

Herald Union Aug 29 2013 By Advantipro Gmbh Issuu

Home Mortgage Loan Interest Payments Points Deduction

Housing Markets With Highest Share Of Equity Rich Households Undergo Biggest Corrections The Business Journals

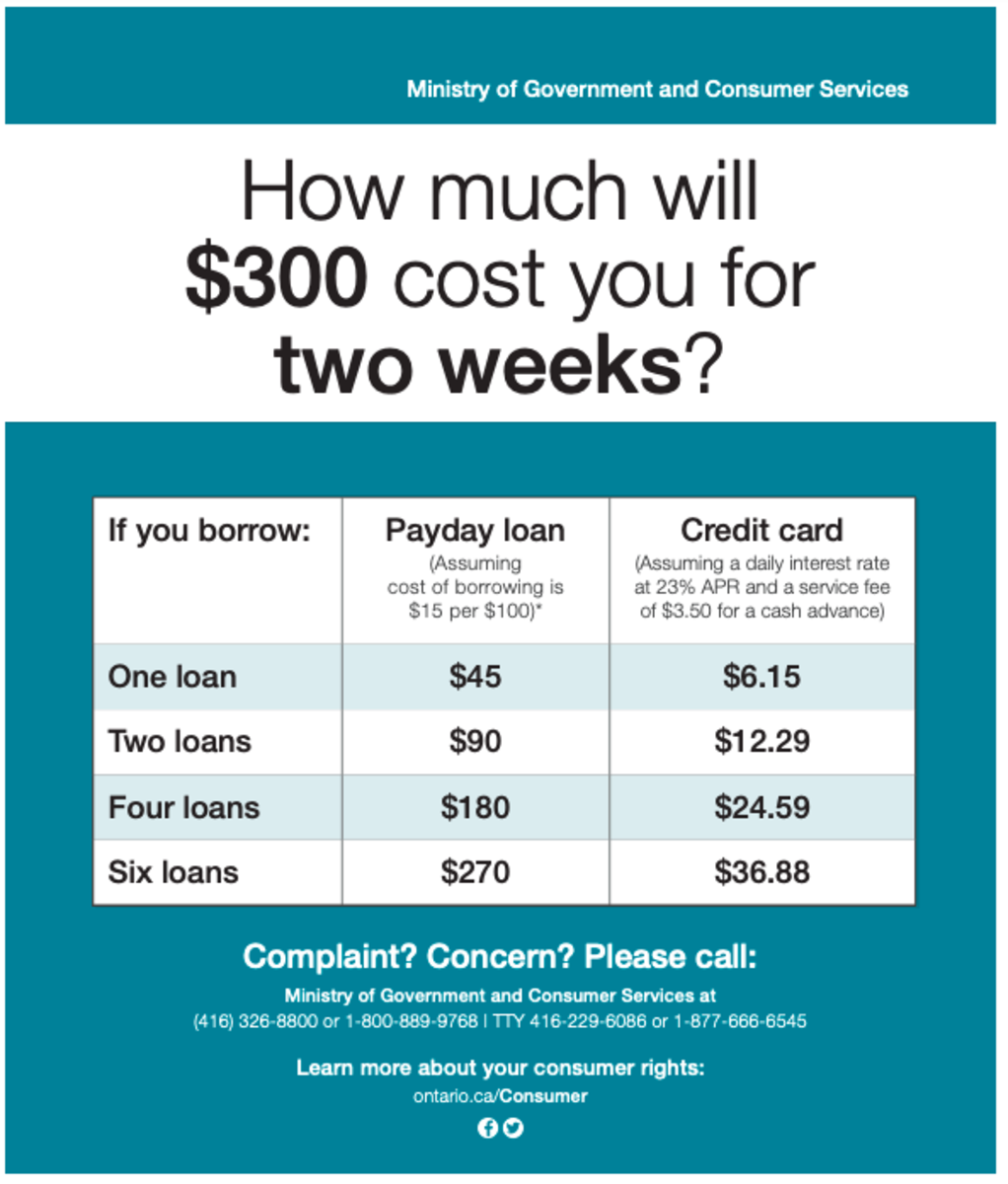

Why You Should Never Get A Payday Loan Canadian Edition Hubpages

Case Study 2 Property Tax Deduction For Owner Occupied Housing Tax Foundation