Car allowance tax calculator

This means your Personal Allowance of 12750 will first be deducted before taxes are applied. Use the following mileage calculator to determine the travel distance in.

2022 Everything You Need To Know About Car Allowances

The 202223 US Tax Calculator allow you to calculate and estimate your 202223 tax return compare salary packages review salary examples and review tax benefitstax allowances in.

. Select the nature of. As amended upto Finance Act 2022. Income Tax Department Tax Tools MotorCar Calculator.

2023 Car Allowance Calculator. Tax payments 3. CAR TAX CALCULATOR 1.

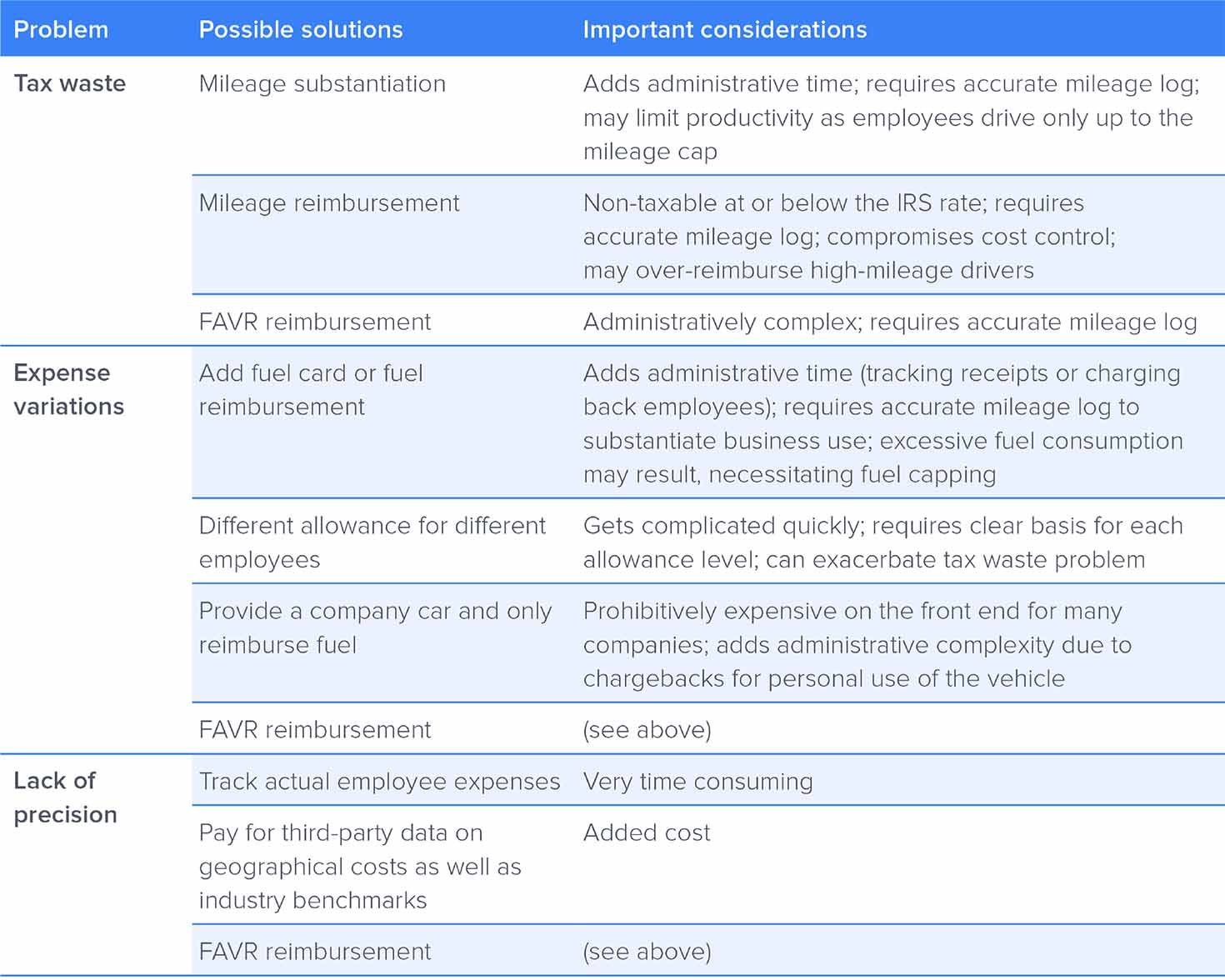

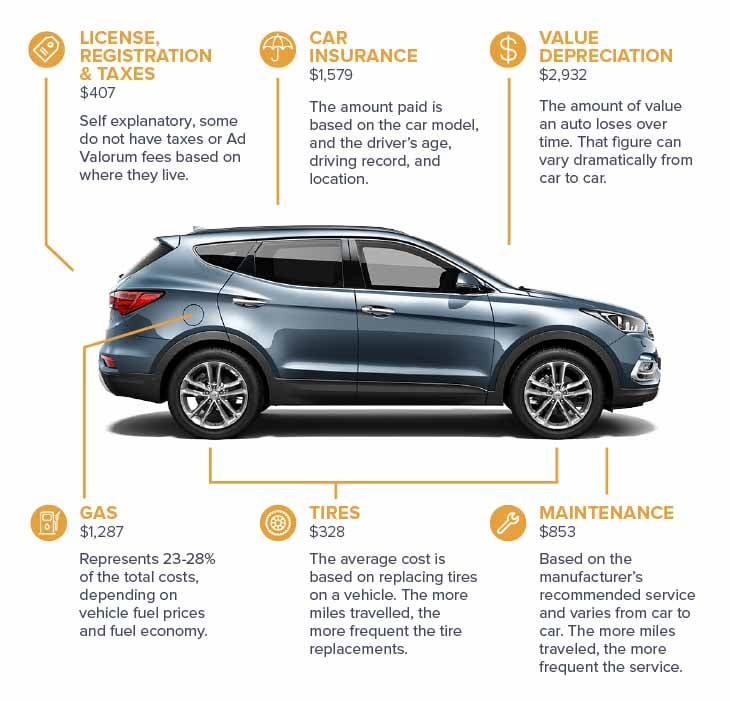

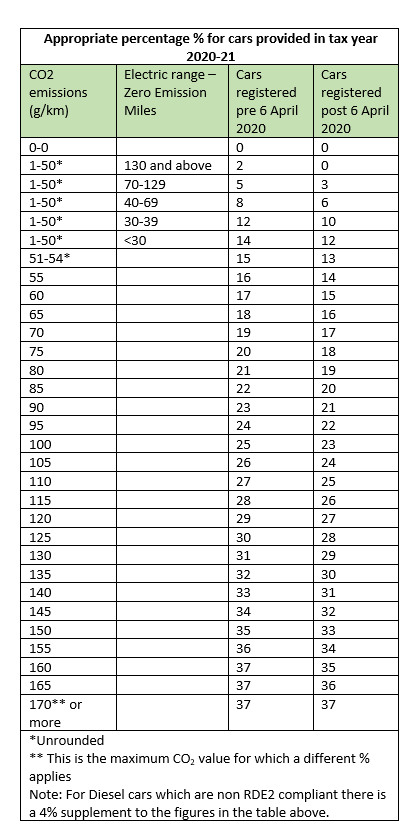

Payment of a car allowance gives rise to a number of tax questions. Current 01 March 2022 - 28 February 2023. Car tax rates are based on fuel type and CO 2.

Super contribution caps 2021 - 2022 -. It can be used for the 201314 to. You can calculate taxable value using commercial payroll software.

Taxability of Motor Car Perquisite. To use our calculator just input the type of vehicle and the business miles youve. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. This mileage calculator estimates the number of driving miles between two locations in the United States. Information relates to the law prevailing in the year of.

10300 for company heads directors and. Tick if Yes Taxable Transport Allowance. 17 cents per mile driven for medical or moving purposes.

Cars and vans after 10000 miles. Whether the assessee is handicapped. Taxability of other than Car Perquisite.

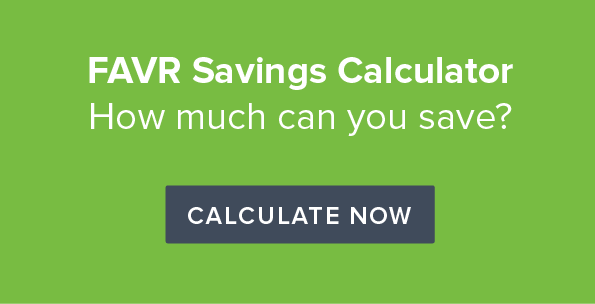

Tax rates 2022-23 calculator. Work-related car expenses calculator. For example a survey mentioned on eReward found that the average car allowance differs from one employee level to the next in the UK.

Your results You can use this service to calculate tax rates for new unregistered cars. Or you can use HMRC s company car and car fuel benefit calculator if it works in your browser. And that too at a rate of 20 per cent on the amount in excess of 12750.

Tax rates 2021-22 calculator. The Automobile Benefits Online Calculator allows you to calculate the estimated automobile benefit for employees including shareholders based on the information you. Add the car allowance to the basic salary and reduce the pension so that the actual amount in for pension is correct in your example salary 70000 pension 514.

01 March 2021 - 28 February 2022. 2022 Car Allowance Calculator.

Allowance Vs Cent Per Mile Reimbursement Which Is Better

2022 Everything You Need To Know About Car Allowances

2022 Car Allowance Policy Calculate The Right Amount

Should You Take A Company Car Or A Car Allowance

2022 Car Allowance Policy Calculate The Right Amount

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How To Calculate Your Automobile Taxable Benefits For The Purposes Of The T4 And Rl1

Tasc Car Deloitte Company Car Calculator Deloitte Belgium Tax

Personal Taxation Of Car Allowance In Canada Youtube

Why Is A Car Allowance Taxable What Sets This Vehicle Program Apart

How To Claim Capital Cost Allowance On Your Vehicle Loans Canada

What Is The Average Car Allowance For Executives I T E Policy I

2022 Everything You Need To Know About Car Allowances

Automobile Benefits Canada Ca

Car Benefits Data Input Calculation 2020 21 Moneysoft

Company Car Or Car Allowance What Do I Choose Youtube